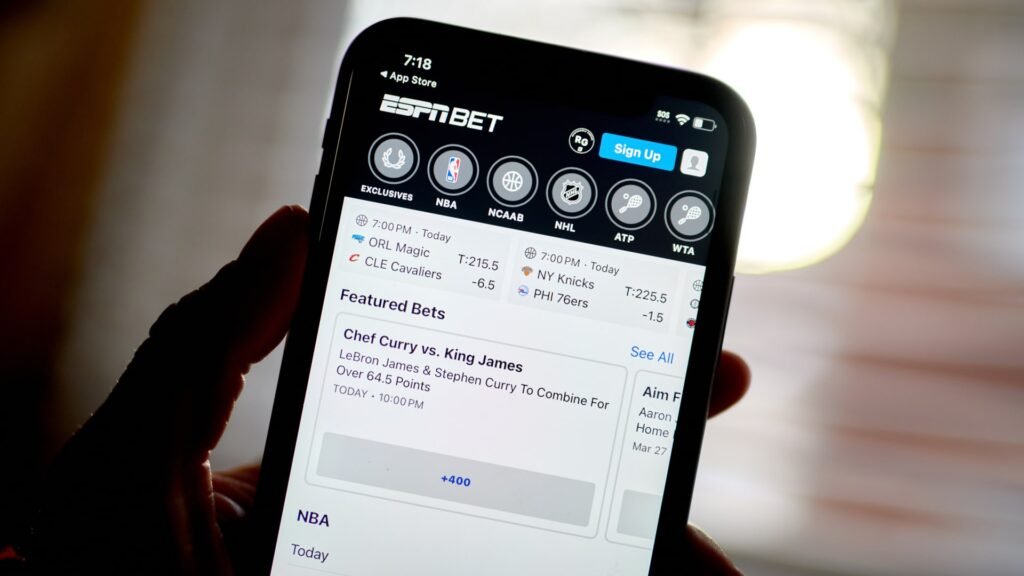

The ESPN Bet app is installed on a smartphone in New York, USA, Thursday, February 22, 2024.

Gabby Jones | Bloomberg | Getty Images

Pen Entertainment The company plans to lay off about 100 employees to focus on growing ESPN Bet.

Chief Executive Jay Snowden told staff in an internal email that the changes would improve operational efficiency following the company’s 2021 acquisition of Canadian media and gaming giant TheScore.

The company employs approximately 20,000 people.

“When PENN acquired theScore, we focused full effort on building out our proprietary technology stack and migrating our sportsbook to theScore’s best-in-class platform,” Snowden wrote in the memo, seen by CNBC, “which temporarily shelved the potential for organizational changes that typically occur after a major acquisition.”

Penn also said the company is embarking on a new phase of growth for its interactive business, which includes ESPN Bet and $2 billion in brand partnerships. Disney ESPN. Snowden said the efforts include enhancing the product and deeper integration into the ESPN ecosystem.

Investors couldn’t wait to see Penn flex its muscles with the rebranded sportsbook, and activist investor Donerail Group called on the board to sell the casino company.

Rumours are circulating that a number of other online gaming and brick-and-mortar casino companies may be interested.

Truist gaming analyst Barry Jonas wrote in a note on Thursday that a sale is unlikely to occur in the near future due to the complexities of a transaction that would likely involve a large divestiture.

Jonas said Penn’s launch of new ESPN Bet features during this fall’s football season should significantly improve the company’s product, and that the focus on costs shows the company’s commitment to seeing return on investment results.

Penn’s shares have plummeted 25% so far this year, and the company has missed profit expectations in each of the past two quarters and lowered its guidance.

“Investors continue to wonder what success for ESPN Bet will look like and how much investment (beyond what has been prescribed) will be required to achieve it,” Jonas noted.

Truist has a buy rating on the pen with a $25 price target.