A version of this article first appeared in CNBC’s Inside Wealth newsletter by Robert Frank, a weekly guide for high-net-worth investors and consumers. sign up Receive future editions directly to your inbox.

Major art sales at major auction houses are expected to be lower than last year in May as wealthy buyers and sellers take a break from the frenzied prices of 2021 and 2022.

Art auction sales at Christie’s, Sotheby’s and Phillips over the next two weeks are expected to total $1.2 billion, down 18% from a year ago and nearly half of May 2022 sales, according to Art Tactic.

This extends the art market’s recent slump from its post-coronavirus peak, when cheap money, a booming stock market and fiscal stimulus led to record sales. According to Art Tactic, global art auctions fell 27% last year compared to 2022, the first art market contraction since the pandemic began in 2020, and average prices fell 32% over the last seven years. This was the biggest decline.

According to ArtTactic, in the first quarter of this year, sales in the modern and post-war category, a major revenue generator and growth driver for the art market in recent years, plummeted 48%.

The auction house says buyer demand remains strong. They say the problem is supply, as collectors are holding back on selling trophies in search of better market conditions. This spring, large single-owner collections, such as the Macklowe and Paul Allen collections that drove sales last year, are also not on sale.

“We’re seeing people identify with smaller pieces this season,” said Brooke Lampley, global chairman and global head of fine art at Sotheby’s. “The proof is in the pudding. The presence of buyers and how much the works sell for will determine our perception of the current art market. And I expect strong results.”

price pressure

Dealers and art experts say the auction art market is stalled over prices, with sellers unwilling to pay lower prices than they would have gotten at the market’s peak in 2021-2022. There is. Meanwhile, buyers are demanding discounts, citing rising interest rates, an uncertain election year and geopolitical uncertainty.

“Sellers want 20% more, buyers want 20% less,” said Philip Hoffman, CEO of advisory and art finance firm Fine Art Group. It’s a stalemate.

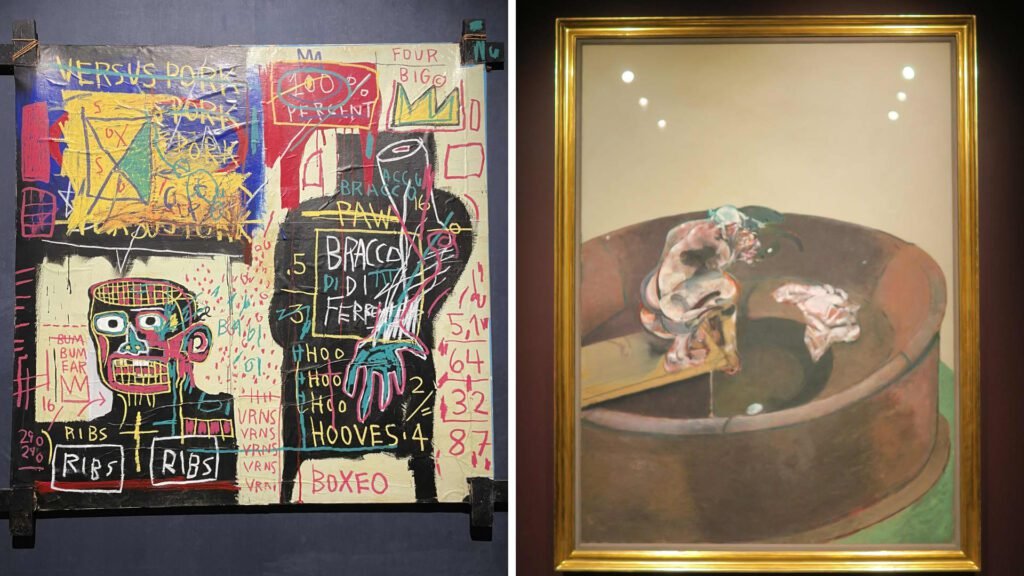

CNBC’s Robert Frank ahead of Andy Warhol and Jean-Michel Basquiat’s collaboration at Sotheby’s.

Crystal Lau | CNBC

Dealers say buyers today are not as confident as they were two or three years ago. Factors such as continued inflation, rising interest rates, concerns about an economic slowdown, upcoming elections and geopolitical crises are causing many collectors to pause their purchases.

“People are hesitant,” said Andrew Fabricant, chief operating officer of the giant gallery and retailer Gagosian. “This is an election year, and there’s also the context of whether or not the Fed will cut rates. The cost of funds is relatively higher than it was a few years ago.”

Experts say even buyers who have the cash and are willing to pay aren’t buying because of the lack of top-quality art being put up for auction.

“Our customers have a lot of cash,” Hoffman said. “What they’re asking is, ‘Should I join the art market now?'”

fewer pieces

Typically, the spring sale features more than a dozen works for more than $30 million each, but this year only a few are on sale.

This auction season’s most expensive works include Francis Bacon’s 1966 painting “Portrait of Crouching George Dyer.” It is part of a series of ten famous and monumental portraits Bacon painted of Dyer between 1966 and 1968. It was sold at Sotheby’s for an estimated $30 million to $50. a million.

(LR) Jean-Michel Basquiat’s “Italian Popeye’s Meal Has No Pork” 1982, Francis Bacon’s “Portrait of Crouching George Dyer” 1966.

Crystal Lau | CNBC

Sotheby’s also has a collection of four paintings by Joan Mitchell, two of which are expected to sell for more than $15 million.

Christie’s is featuring “Event,” a blockbuster by Brice Marden, who passed away last year, estimated at $30 million to $50 million. Also on display is Jean-Michel Basquiat’s iconic 1982 work “Italian Popeye’s Meal No Pork” (estimated at $30 million).

But collectors and art advisors say there are few, if any, “masterpiece” works to generate excitement this season.

“We just don’t have the material for Marquis this season,” Fabricant said. “I don’t think we’ll have the same enthusiasm for sales as we have in the past unless there’s something really unique and special.”

At the same time, art experts say now is a good time to look for bargains, given the long-term outlook for the art market.

“If you can get it at a price before 2022 and it’s high quality, I think now is the time to buy,” Hoffman said. “My outlook for the art market over the next 10 years is that it’s going to be a great investment. It’s a great time to buy, but it’s not a great time to sell.”

Advisers say that while auction sales have slowed, private market and gallery sales remain strong. Gallery sales of new work are less dependent on investment returns and are therefore less affected by economic and stock market fluctuations. Auction houses have also seen significant growth in private sales, which broker transactions directly between buyers and sellers without going through public auctions.

Christie’s sold a Mark Rothko painting to hedge fund billionaire Ken Griffin for more than $100 million earlier this year, CNBC previously reported. Collectors argue that selling trophy works privately reduces the risk of auction failures that can erode a work’s value.

“Private markets are becoming very targeted in terms of who you reach and what types of buyers you reach,” said Drew Watston, head of art services at Bank of America. There is a possibility that it will happen.” “We can be very targeted about the prices we go to market and ask for. We have a lot of discretion, so we can go out to market and test prices and adjust according to the feedback we get.”

Sign up to receive future issues of CNBC inner wealth Robert Frank Newsletter.