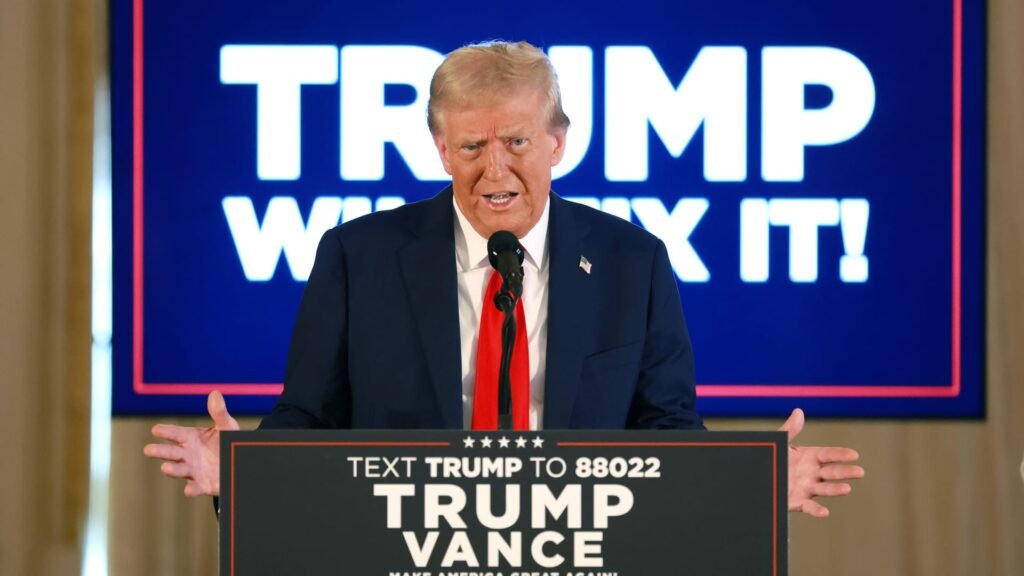

Three stocks are making waves among day traders hoping for a Donald Trump victory next week. Individual investors are increasingly focusing on Trump Media & Technology, Rumble and Funware as stocks that could benefit if the Republican presidential candidate wins. This has already put many candidates in strong motion, but more names could come forward as Americans head to the polls. Some of these stocks have more obvious ties to former presidents than others. Trump Media & Technology, which owns alternative social media platform TruthSocial, trades under the ticker “DJT,” which are also the business mogul-turned-politician’s initials. Phunware created President Trump’s campaign app, and Rumble is a video platform focused on conservatives. Indeed, these trades are considered risky due to their high volatility and poor financial condition. None of these companies will be profitable in 2023. Trump Media, the largest of the three companies by market capitalization, accounted for less than 25% of the S&P 500’s median value of $37.6 billion. Moreover, few, if any, analysts on Wall Street cover these names. The latest NBC News poll also shows a tight race between him and Vice President Kamala Harris. “Making financial bets based on which stocks you think will do best based on election results is nothing new,” said Christopher Schwartz, a professor of finance at the University of California, Irvine, in a study. The division focuses on individual traders. But when it comes to stocks like DJT, “there is no fundamental reason why these stocks should be priced anywhere near their current prices.” Still, these names are sure to make headlines and pop up on forums like Reddit’s WallStreetBets right before and after the election. CNBC compiled more information about these names and what’s sparking interest from some traders: Trump Media & Technology considering the candidate’s stock was worth more than $5 billion as of earlier this week. And TruthSocial’s parent company is getting the most attention. He owns approximately 114 million shares, which equates to ownership of more than half of the company. The stock has been trading volatile in recent days as voting day approaches. Shares soared more than 20% on Wednesday, reversing a jump of more than 8% a day earlier. By Wednesday, stocks were showing pre-election gains. This brought the stock price out of the slump that had once dropped below $12. Tuesday’s closing price was $51.51. The stock is now up more than 160% in October, the first positive month since March. Year-to-date, it’s up more than 140%. Net inflows into Trump Media from retail investors rose to the highest level this year in recent days, according to data analyzed by Vanda Research. This confirms that the name is attracting attention during pre-election rallies. On Tuesday alone, retail traders netted $14.4 million in Trump Media. The stock is also the most talked about stock on WallStreetBets, a Reddit page popular with meme stock traders, over the past seven days, according to data from Quiver Quantitative as of Wednesday afternoon. The stock has been mentioned more than 17,000 times on forums this year, the company said. The president and vice president of the United States are largely exempt from government conflict-of-interest rules. Still, Trump will be the first president to become president while running a publicly traded company. His holdings in DJT represent nearly 75% of his net worth. President Trump has said he has no intention of selling his position. “There has never been a special case in which a potential future U.S. president had such a direct economic impact on a particular company,” said Schwartz of the University of California, Irvine. I think so,” he said. Schwartz said there is no reason for Trump Media to even go public, given its business fundamentals and high price-to-sales ratio. With that in mind, he said the trade was based solely on “speculation.” “Trump media has no fundamental value. It’s worthless,” he said. “That’s why the outcome of the election will probably have a big impact on the stock price.”Trump Media reported a loss when looking at net income and EBITDA for 2023. The company had 36 employees at the end of last year. Two other stocks, Funware and Rumble, have less direct ties to Republican candidates. Phunware is promoted as a mobile software and blockchain company. In addition to the Trump campaign app, Phunware lists Marriott, Atlantis, and Mayo Clinic as clients on its website. The stock has fluctuated wildly over the past year, with highs above $24 and lows trading below $3. According to FactSet, the company had just 25 employees at the end of 2023, and was in the red in terms of net income and EBITDA for the year. Net inflows into Phunware from retail investors also increased in October, according to Vanda data. The stock price has increased more than 140% in the past month. It is on track to rise more than 80% in 2024, ending its two-year losing streak. All 4 analysts surveyed by LSEG have rated the stock a Buy since the beginning of the year. The average price target suggests the stock has a nearly 90% chance of trading above the $15 mark. Indeed, price target estimates vary widely even within this group, ranging from a low of $8 to a high of $20. Rumble, on the other hand, doesn’t see a similar spike as November 5 approaches. Still, the company is seen as having ties to President Trump, given its popularity among conservatives as a video platform. The company had just under 160 employees at the end of last year and posted a loss in net income and EBITDA for the year. It went public in September 2022 with the backing of PayPal co-founder Peter Thiel. The stock rose 13% in October, bringing the year-to-date gain to 36%. Over the past 52 weeks, the stock has traded within a narrower range, between $3.33 and $9.20. Two analysts surveyed by LSEG both rate the stock as a hold. Both companies have price targets of $8, suggesting their shares could rise more than 34% over the next year. — CNBC’s Robert Frank and Fred Imbert contributed to this report.