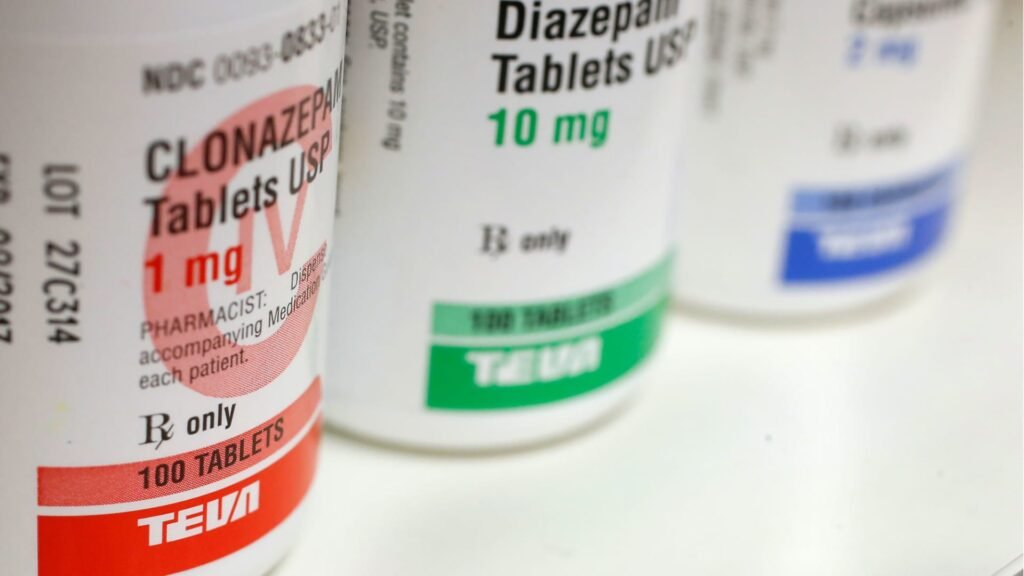

Check out the companies that made headlines in midday trading: Teva Pharmaceuticals, Sanofi — after both companies announced positive Phase 2b results for Dubakitug, a joint treatment for moderate to severe patients. Shares of Teva Pharmaceuticals and Sanofi rose more than 26% and 6%, respectively. Inflammatory bowel disease. Pfizer — Shares rose more than 4% after the biopharmaceutical company’s 2025 outlook matched Wall Street expectations. Pfizer expects sales of $61 billion to $64 billion next year, in line with the consensus estimate of $63.22 billion, according to FactSet. Quantum computing — Stocks soar more than 51% after NASA’s Goddard Space Flight Center awards the company a prime contract to support the agency’s needs for advanced imaging and data processing using Quantum’s entropy quantum optimization machine and hit a new 52-week high. As Dirac-3. SolarEdge Technologies — Shares soared more than 16% after Goldman Sachs upgraded the company from buy to sell twice. The bank said 2025 will be a key turning point in the clean energy company’s major turnaround story. Red Cat — The drone technology company fell more than 7% after reporting a loss of 18 cents per share in second-quarter results. This was worse than the loss of 11 cents per share in the year-ago period. Red Cat stock is currently up about 17% over the past week, with optimism that Wall Street could pump more money into the industry following mysterious drone sightings in New Jersey. The price has soared due to a growing number of people’s views. Nvidia, Broadcom — Shares of Nvidia and Broadcom fell more than 1% and nearly 4%, respectively, as chip stocks moved in opposite directions in early trading. On Monday, NVIDIA fell into correction territory. Meanwhile, Broadcom reported better-than-expected fourth-quarter profits on Thursday, and the company’s market capitalization topped $1 trillion on Friday. It has risen more than 39% in the past week. Tesla — The electric vehicle stock rose more than 3% after Mizuho upgraded its rating from neutral to outperform. The company said it expects Tesla to benefit from regulatory changes expected by President-elect Donald Trump, including related to self-driving cars. Manchester United — Shares rose about 3% after UBS initiated coverage with a buy rating. The company believes the UK-based professional football club’s “superior” revenue base could ultimately lead to improved sporting performance and net profit for the team. Epam Systems, Cognizant Technology Solutions — IT services stocks rose about 2% and 0.4%, respectively, after Barclays upgraded them from equal weight to overweight. The British bank said it had made investments to help capture demand as these companies return to the sector. Affirm Holdings — Shares fell 2.7% after the buy now, pay later company announced a private placement of $750 million in convertible notes. Affirm also said it plans to repurchase up to $300 million of its Class A common stock. Amentum Holdings — The engineering firm and government contractor fell more than 9% after reporting quarterly results. Amentum reported a pro forma loss of 21 cents per share in its fiscal fourth quarter. This compares to earnings of 17 cents per share in the year-ago period. —CNBC’s Alex Harring, Lisa Kailai Han, Pia Singh and Michelle Fox contributed reporting.